To obtain a quotation for insurance you can either go online or call up the insurance companies and talk to them to explain your requirement and then get a quotation. Online quotations are easy to obtain, its fast and you can obtain multiple quotations within a very short time. On the other hand, talking to insurance companies would mean that it might take you a few days even to get several quotations. And since there are so many different kinds of discounts, schemes and offers to lure customers it is only natural that you would like to explore as many companies as possible so that you get the best quotation. So, what would be the best way to get quotations? Both the processes of getting quotations online and over phone have its own pros and cons that have been discussed in this article.

Online Quotations

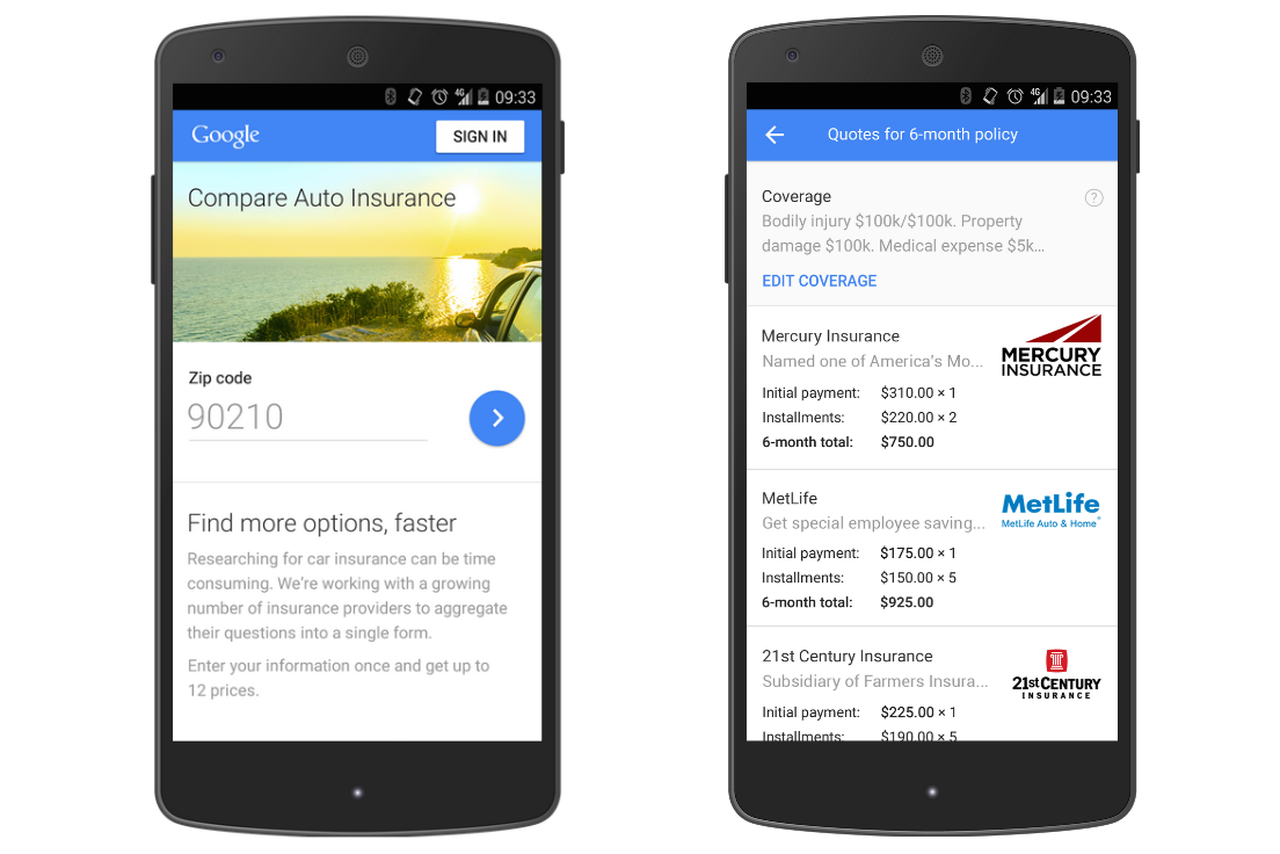

When you are seeking online quotations, it is presumed that you have a fair idea about the kind of insurance product you are looking for. You must know exactly what you want and outline your needs objectively to frame a comprehensive enquiry that can be evaluated by the insurance company to respond with an appropriate quotation very promptly. But the most important thing is that you need to be an expert in insurance to know what is good for you so that you ask for a specific product and this can be quite challenging.

Lack of Interaction

After you get the quotation, you might need something to be clarified. But there is no scope of any further interaction to sort out things.The incomplete quotation would be of no use to you. Online quotations are straight jacketed and might leave you asking for more.The process is fast but cannot always ensure to be conclusive for your needs unless your needs match with what is on offer.

Telephonic Enquiry

The limitation of online quotations is addressed very well in the process of telephonic enquiries for obtaining insurance quotations. You call up an insurance company and engage in discussion with the representative to place your enquiry and explain your requirement in every detail so that it saves the time of the company in sending the right quotation to you. During the interaction, you can gain valuable knowledge about the product that you are inquiring about and also come to know about some other products that may be offered to you, which might be more suitable in meeting your needs. In the process, you are exposed to many options and use the representative’s advice to select the right product with confidence.

Insurance needs are very specific and cannot be captured within a pre-designed framework that is applicable for online quotations. The guidance and advice of professionals that is available during telephonic enquiries can add considerable vale to the insurance policy that you choose. Since individual needs are specific, insurance policies have to be customised to make it best for you and what could be better than getting an opportunity to explain your needs in minutest details by talking over phone.